From 6 Tabs to One Question: A Better Way to Research Stocks

I used to spend 45 minutes researching a single stock. Now I ask one question and get a clear answer in 2 minutes. Here's what changed.

StockGenie Team

December 27, 2025

I used to spend 45 minutes researching a single stock - flipping between tabs, Googling terms I didn't understand, still feeling uncertain. Now I ask one question and get a clear answer in 2 minutes. Here's what changed.

The Problem Nobody Talks About

Here's the reality of being a retail investor: you're competing with people who do this full-time.

Institutional traders have Bloomberg terminals, analyst teams, and real-time data feeds. They have interns who summarize earnings calls and algorithms that spot patterns before you've finished your morning coffee.

What do we have? Google. Reddit. A bunch of browser tabs. And hope.

The information is technically "out there" - but by the time you piece it together, the move already happened. Or you spent so long researching that you missed your window. Or you finally understand what RSI means but forgot why you were looking at the stock in the first place.

It's not that we retail investors are dumb. It's that we're fighting with worse tools and less time.

How Most People Handle This

I've been trading casually for a few years, and I've been all of these people at different points:

The DIY Researcher

This was me for a long time. Someone mentions a stock, and I'd open:

- Yahoo Finance for price and basic stats

- TradingView for charts

- Seeking Alpha for analysis

- r/stocks for sentiment

- Google for "what does VWAP mean"

- Another tab to compare with competitors

45 minutes later, I'd have 15 browser tabs, conflicting opinions, and still no clear answer on whether to buy.

The pain: Time-consuming, and I'd still feel uncertain.

The News Follower

Some people just follow headlines. CNBC says "NVDA is hot," so they buy. A YouTuber says "AMD to the moon," so they're in.

No idea what price is actually good. No plan for when to sell. Just vibes.

The pain: Always late to the party, no entry or exit strategy.

The Gut Trader

"This one just feels right."

No process, no system. Sometimes it works, sometimes it doesn't. Learn nothing either way because there's nothing to analyze.

The pain: No repeatable edge, just gambling with extra steps.

The Overwhelmed Beginner

This one hurts because everyone starts here. You want to learn, but every resource assumes you already know the basics. YouTube videos throw around terms like RSI, MACD, P/E ratios - and you're still trying to figure out what a limit order is.

The pain: Paralyzed by complexity. Can't even start.

What I Actually Wanted

I didn't need to become a professional trader. I just wanted:

- Ask a simple question, get a useful answer - not a 20-page report

- Real data, not generic advice - actual numbers for the stock I'm looking at

- Explained in plain English - without assuming I have a finance degree

- Fast enough to actually use - not a 45-minute research project

That's it. Not asking for magic. Just a way to make informed decisions without sacrificing my entire evening.

So I Built Something

After years of the 6-tab ritual, I decided to build what I actually wanted: a tool that answers stock questions directly, with real data, in plain English.

That became StockGenie.

I'm not going to bore you with how it works under the hood. What matters is what it does:

- You ask a question about a stock

- It pulls live data, runs the analysis, and gives you a clear answer

- In plain English, with the reasoning explained

It's not generic chat that hedges everything with "I can't give financial advice." It's a specialized tool that does one thing well: help you understand stocks faster.

Let me show you what I mean.

How It Actually Works

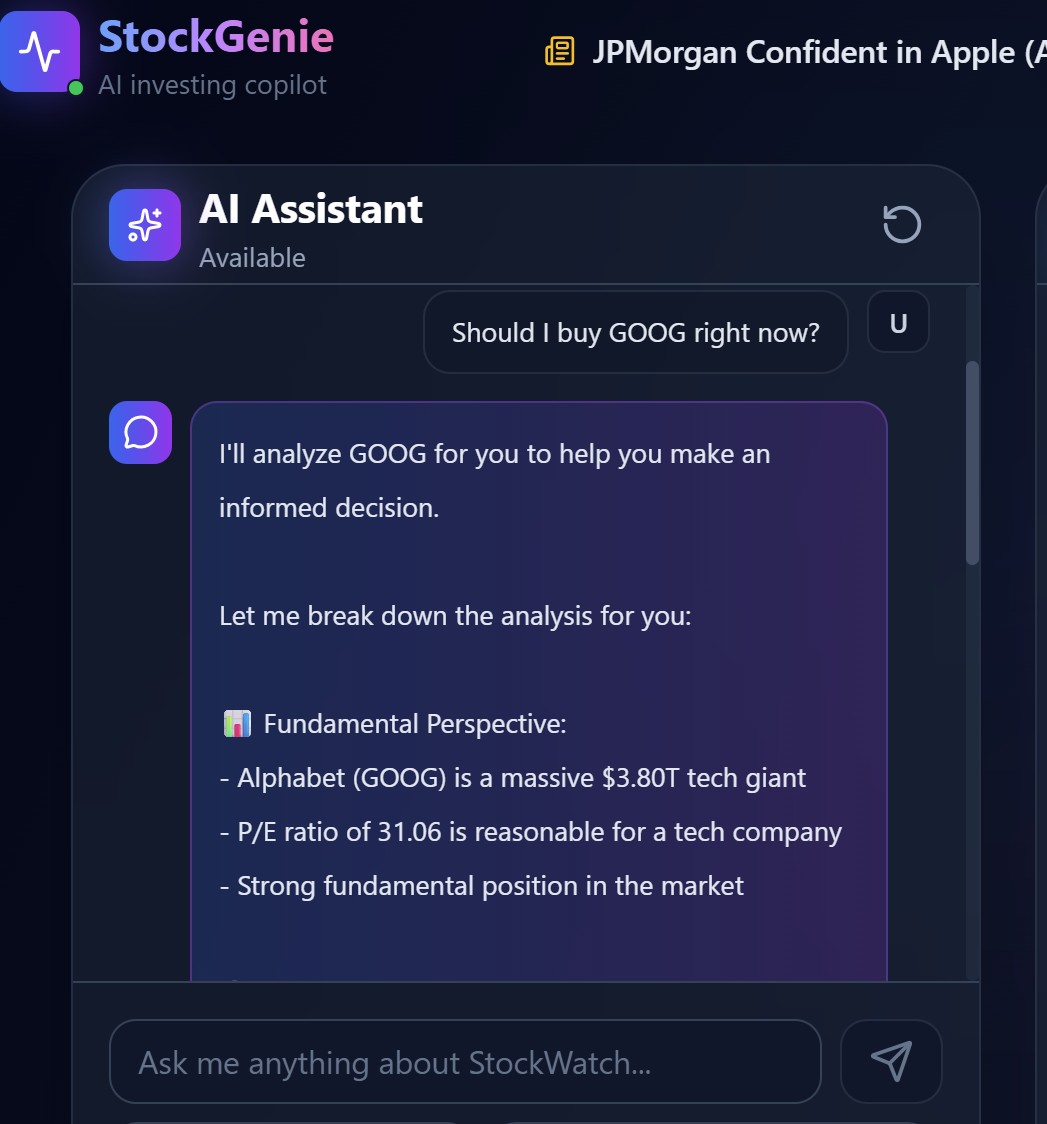

Example 1: Quick Stock Analysis

I kept seeing GOOG mentioned after their AI announcements. Old me would've started the 6-tab ritual. Instead:

I asked: "Should I buy GOOG right now?"

I got:

In about 30 seconds, I had:

- Current price and where it sits vs recent highs/lows

- Technical signals (RSI, moving averages) explained simply

- Fundamental snapshot (P/E, market cap, sector context)

- A clear bottom line with reasoning - not just "buy" or "sell" but why

No tab switching. No Googling. No confusion.

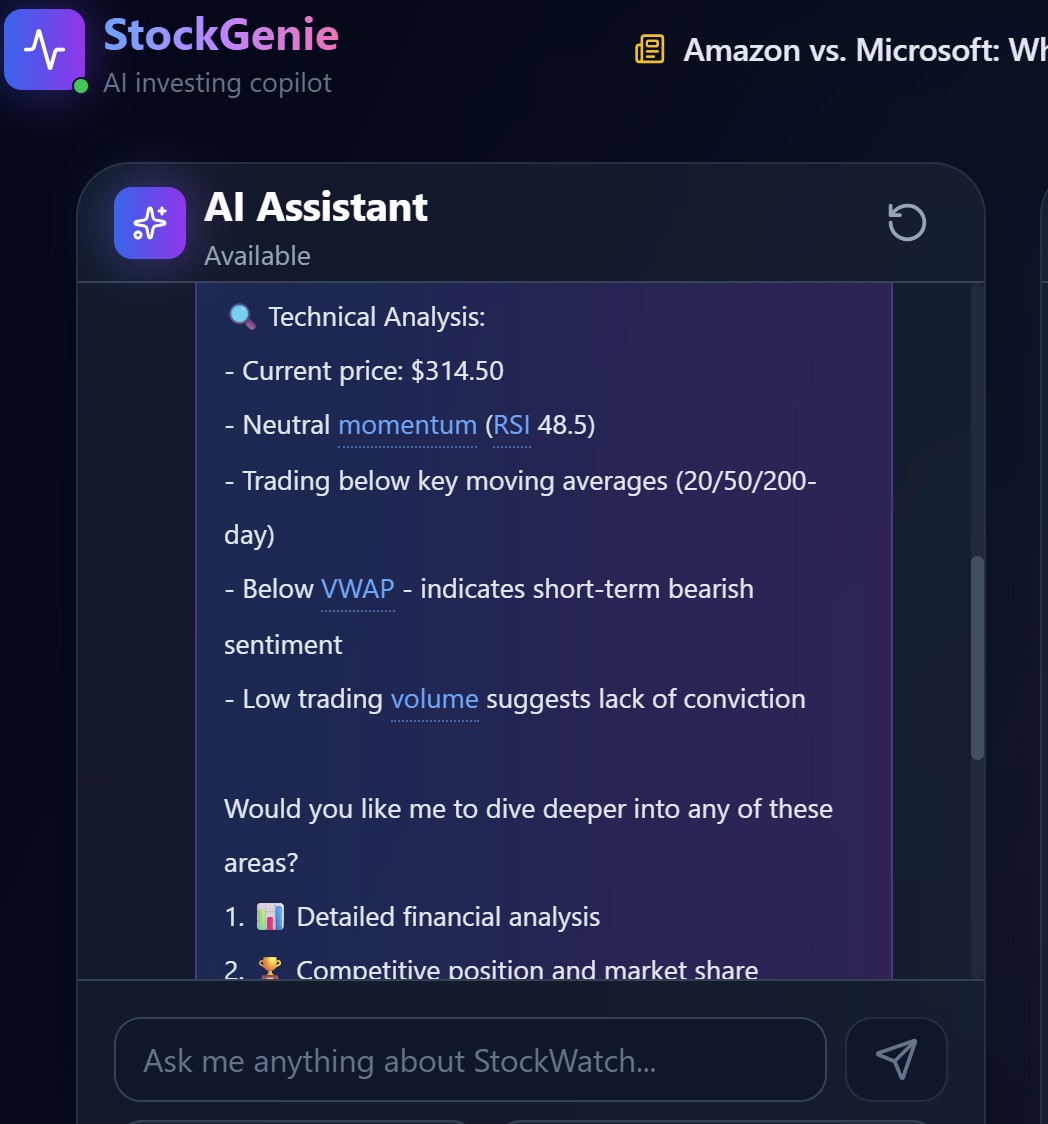

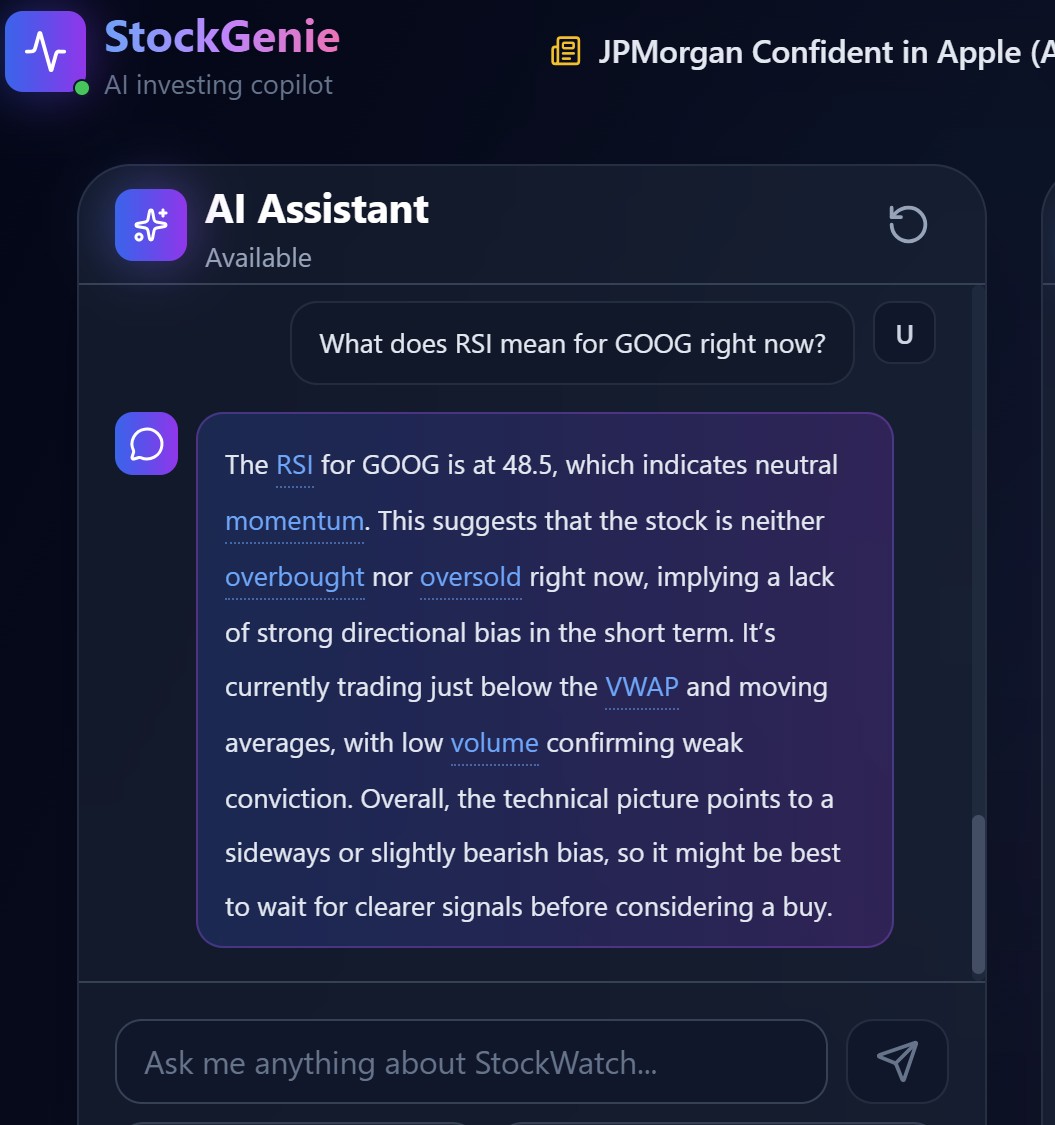

Example 2: Learning in Context

Here's the thing - I still didn't fully understand what RSI meant. But instead of opening a new tab to Google it, I just asked:

I asked: "What does RSI mean for GOOG right now?"

I got:

It didn't give me a textbook definition. It explained what RSI is, what GOOG's current RSI reading means, and what that typically signals - all in the context of the stock I was actually looking at.

That's how you actually learn. Not abstract concepts, but practical understanding you can use immediately.

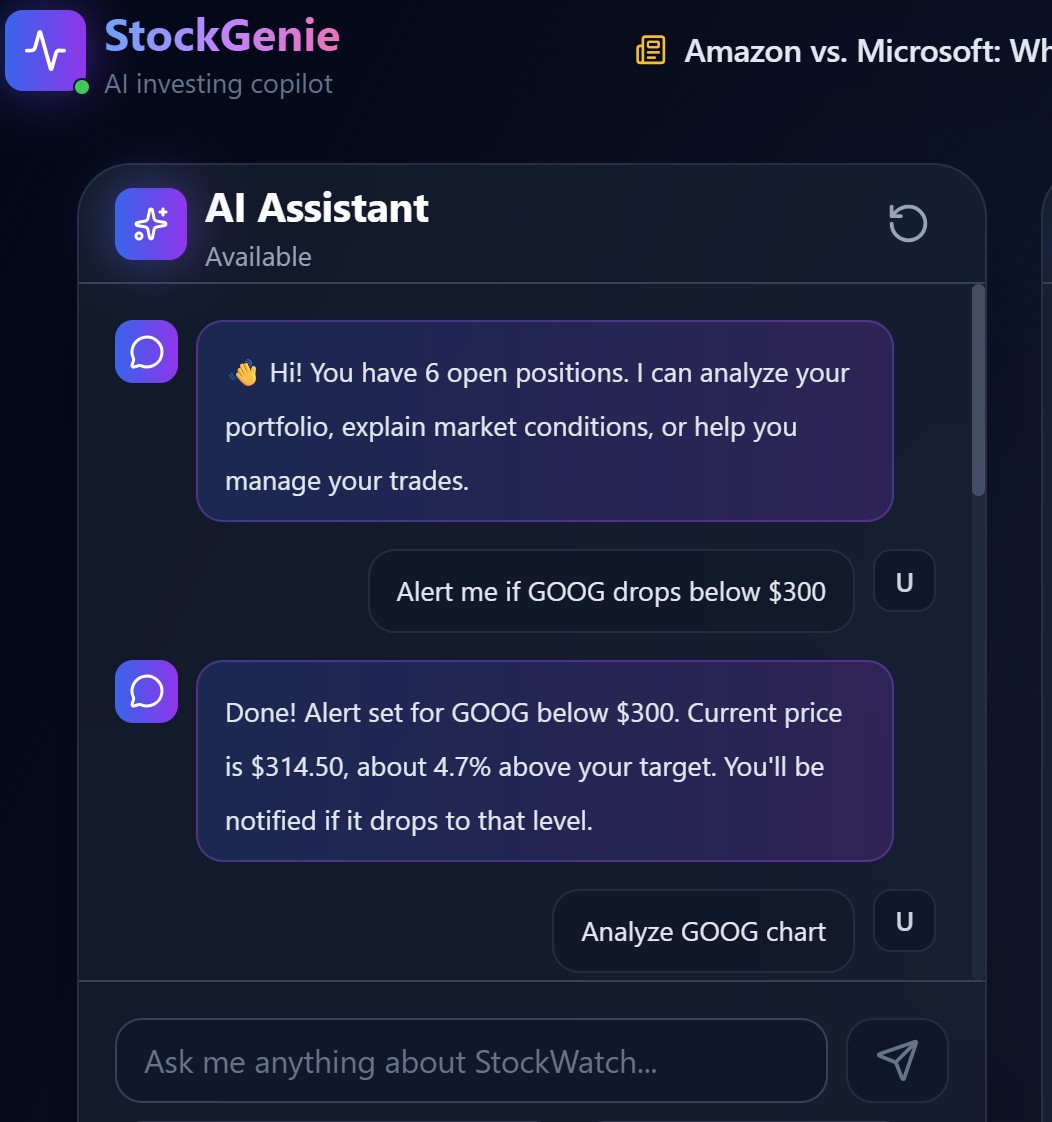

Example 3: Setting Alerts Without the Hassle

I wanted to wait for a better entry on GOOG. On most platforms, setting up an alert means navigating through menus, configuring conditions, hoping you set it up right.

I asked: "Alert me if GOOG drops below $300"

I got:

Done. One sentence. The alert is set, I'll get notified, and I can move on with my day.

What This Doesn't Do

I'm not here to oversell this. Let me be clear about what StockGenie doesn't do:

- It doesn't guarantee returns. Nothing does. Anyone who promises that is lying.

- It doesn't make decisions for you. It gives you information. You decide.

- It's not always right. I still verify important data points before making big moves.

- It doesn't know your situation. Your risk tolerance, your portfolio, your goals - that's on you.

My mental model: it's a research assistant, not a portfolio manager.

I use it to gather information faster and understand what I'm looking at. The decision is still mine.

My Workflow Now vs Before

Before

- See a stock mentioned on Reddit or in the news

- Open Yahoo Finance, TradingView, Seeking Alpha, Reddit

- Spend 30-45 minutes reading conflicting opinions

- Google half the terms people are using

- Either give up or make a half-informed decision

- Miss the setup because I was still researching

Now

- See a stock mentioned somewhere

- Ask one question, get a structured analysis

- If interesting, set an alert for key levels

- Make a decision based on clear information

- Move on with my day

The research that used to take 45 minutes now takes 2-5 minutes. And honestly, the quality is better because I'm getting organized analysis instead of piecing together random tabs.

Who This Is For

I built this for people like me:

- I don't have hours for research every day

- I'm not a professional trader and don't want to be

- I want to understand what I'm buying, not just gamble

- I'd rather learn while doing than study for months before starting

If that sounds like you, it's worth trying.

Probably not for you if:

- You enjoy deep manual research (some people do, and that's valid)

- You're already a technical analysis expert

- You fundamentally don't trust any tools and want to do everything yourself

No tool is for everyone.

The Bottom Line

I built StockGenie because I was tired of spending 45 minutes on research that should take 5. It solved my problem, and I think it might solve yours too.

If you've ever felt overwhelmed by the research process, or wished there was a faster way to get useful analysis without drowning in tabs - give it a try.

Ask one question about a stock you're curious about. See if the answer is useful. Then decide for yourself.

Written by the founder of StockGenie. Have questions? Use the feedback button in the app - I read every message.